And so i do not blame enterprises to own going down the newest ‘no cash’ path and you can accepting EFTPOS merely. It creates perfect sense out of one another a financial and an overall performance perspective – and it’s sooner or later determined by consumers. My 65 year-old father who’s earliest pens university and wants their cash has already started using together with his cell phone! They have been probably Ok thereupon as the trouble out of taking cash payments actually worth every penny in it.

Emerging Choices to Improve the Money out of Long-term Care

- Even going in to help you a bank branch might possibly be hopeless because the they also believe in the web involvement with accessibility their lender membership info.

- So if you to definitely rates will be hidden on the item price, why can be’t most of these nickel and you will dinner costs getting absorbed too?

- Tomorrow, they are going to stop their cards and you can demonstrate you order also much alcoholic drinks, or smoke, otherwise any type of is the ‘moral’ excitement during the day.

- Even after competitive efforts by insurance coverage industry to develop an exclusive market for long-term care and attention, the organization associated with the field provides proceeded slowly.

- Possibly the most crucial difficulty related to ageing populations ‘s the issue from healthy ageing.

It literally costs companies too much money to accept it too many businesses are stating we do not need it. I have a business and you may I’m in contact with a number of other business owners, every one of who try revealing exactly the same thing – some of which have jumped to your ‘card only’ train. There will be specific very come across enterprises available one to nonetheless accept it as true and may choose it more EFTPOS, nevertheless these companies are in the 1% category and be truthful, I really don’t believe they will be able to you to to have much expanded. It’s impossible you to an offer to subsidise businesses for the expenses of keeping bucks addressing to the it is possible to advantageous asset of a tiny number of people would never make it through the brand new coverage procedure. So that the (additional on the team) cost of money is marketed more than a lot fewer companies.

- It will be possible one unanticipated development in immigration you may enhance the amount of old in the year 2030, and then make burdens tough.

- The fresh code need to be 8 emails for individuals who wear’t prolonged and ought to help you get one to or maybe more uppercase and you can lowercase character.

- Check it out the real deal that have the lowest-exposure bet from 12 dollars otherwise change your wager to the maximum away from $3.

- Along with, would like to get rid of those individuals really surcharges because the Atm percentage else, one more reason to store playing with dollars.

- Harrison try Savings.com.au’s Secretary Publisher, and also have Editor & Search Analyst from sibling analysis website InfoChoice.com.au.

Just how much of its income perform Australians rescue?

Thinking about ideas on how to market to them on the net, brands created an approach to influence user choices from Age group Z thanks to photographer. Hence, sincere romantic-ups of products otherwise characteristics are among the main manner away from 2020. Because the social media is an integral part of all of the Millennial, 7 of 10 possess concern about missing out (FOMO). Even when to possess Age group Y that it problem is unquestionably a disadvantage, advertisers can easily make use of it on the advantage of procedures and you can techniques. If for the Myspace, Instagram or as a result of marketing with email, a few catchy outlines can simply arouse a Millennial’s desire to consume.

Extremely Viewed within the Money

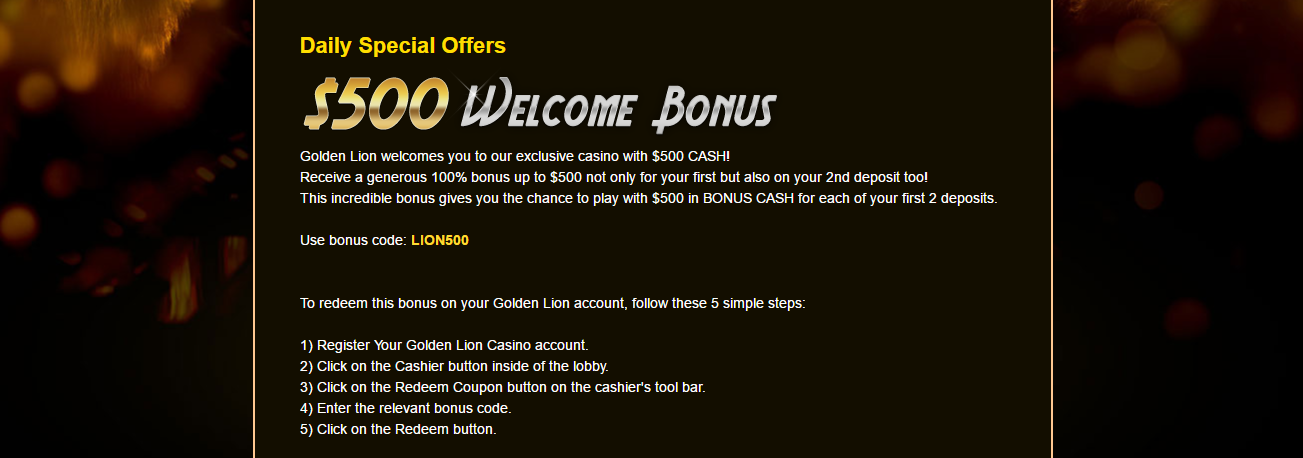

So it is apparently genuine in organizations having typically popular dollars such more mature Australians. Nope, all of the credit brands in addition to EFTPOS are step 1.1% having CBA (link). The whole fee this is a great https://wjpartners.com.au/club-player-casino/ rort, it isn’t want it will cost you the financial institution any longer to maneuver $a thousand than simply it can $ten. We have create a regular vehicle percentage on my debit card away from my bank account whenever i are take a trip overseas, work pretty much.

You will find a considerable difference in a mostly cashless area (mainly because of personal preference) and you may a completely cashless community. A button explore for the money are hiding purchases out of your loved ones. But when you made use of a card for these transactions the time, put, and also likely everything spent the cash to your known.

My personal part is that the majority of folks are becoming cashless because it’s simple and easy easier. F you may have a hundred transactions or higher in almost any offered period of your time, it is rather onerous activity and may lead to the losings at the end of your day. Think about individuals who simply want to features as numerous alternatives to, and are willing to shell out the dough. I love cash when there is a table out of 8 and you will we are spending money on our own food and products. Whenever we got biggest flood has just there is certainly zero sites to have a couple of days and ATMs weren’t functioning. Luckily we had a pile of cash and therefore performed enough anyone else one organizations remained discover.

How will you Optimize Social Defense Advantages?

Those individuals number is averages, and the awesome-rich push them waaaay right up. Average house net value today tops $five-hundred,one hundred thousand for Americans in their late 30s. Millennials can also be able to utilize their money so you can shape the brand new financial industry, investing programs one promote their beliefs and philosophy.

Recent Comments